Things about Mileagewise - Reconstructing Mileage Logs

Little Known Facts About Mileagewise - Reconstructing Mileage Logs.

Table of ContentsThe Best Strategy To Use For Mileagewise - Reconstructing Mileage LogsThe Best Strategy To Use For Mileagewise - Reconstructing Mileage LogsThe Definitive Guide for Mileagewise - Reconstructing Mileage LogsUnknown Facts About Mileagewise - Reconstructing Mileage LogsThe Best Strategy To Use For Mileagewise - Reconstructing Mileage LogsAll About Mileagewise - Reconstructing Mileage Logs

The NSA. Facebook. Big Sibling. People living in the 21st century face an unmatched awareness of ways they can be monitored by effective companies. No one wants their boss contributed to that listing. Or do they? An independent survey conducted by TSheets in 2016 located that just 5% of employees who had actually been tracked by companies making use of a general practitioner system had an unfavorable experience.(https://gravatar.com/superbly7e3323a212)In 2019, mBurse evaluated mobile workers concerning GPS tracking and located that 81% would sustain their company tracking their company gas mileage if it implied obtaining full repayment of car expenditures. On the whole, while some employees express issues concerning micromanagement and being tracked after hours, those that have actually been tracked find those problems largely reduced.

In order to recognize the advantages of GPS mileage logs without driving staff members out the door, it is essential to select an ideal GPS app and institute standards for proper usage. Drivers ought to be able to edit trips and mark particular portions as personal to ensure that no information about these trips will be sent out to the employer.

Mileagewise - Reconstructing Mileage Logs - Questions

Vehicle drivers ought to additionally have the ability to switch off the application if necessary. Even if you have information on your staff members' location during company travel doesn't indicate you have to have a conversation regarding every information - mileage log for taxes. The key purpose of the general practitioner app is to supply accurate gas mileage tracking for compensation and tax purposes

It is common for many organizations to check workers' usage of the web on business gadgets. The easy reality of checking prevents unproductive net use without any micromanagement.

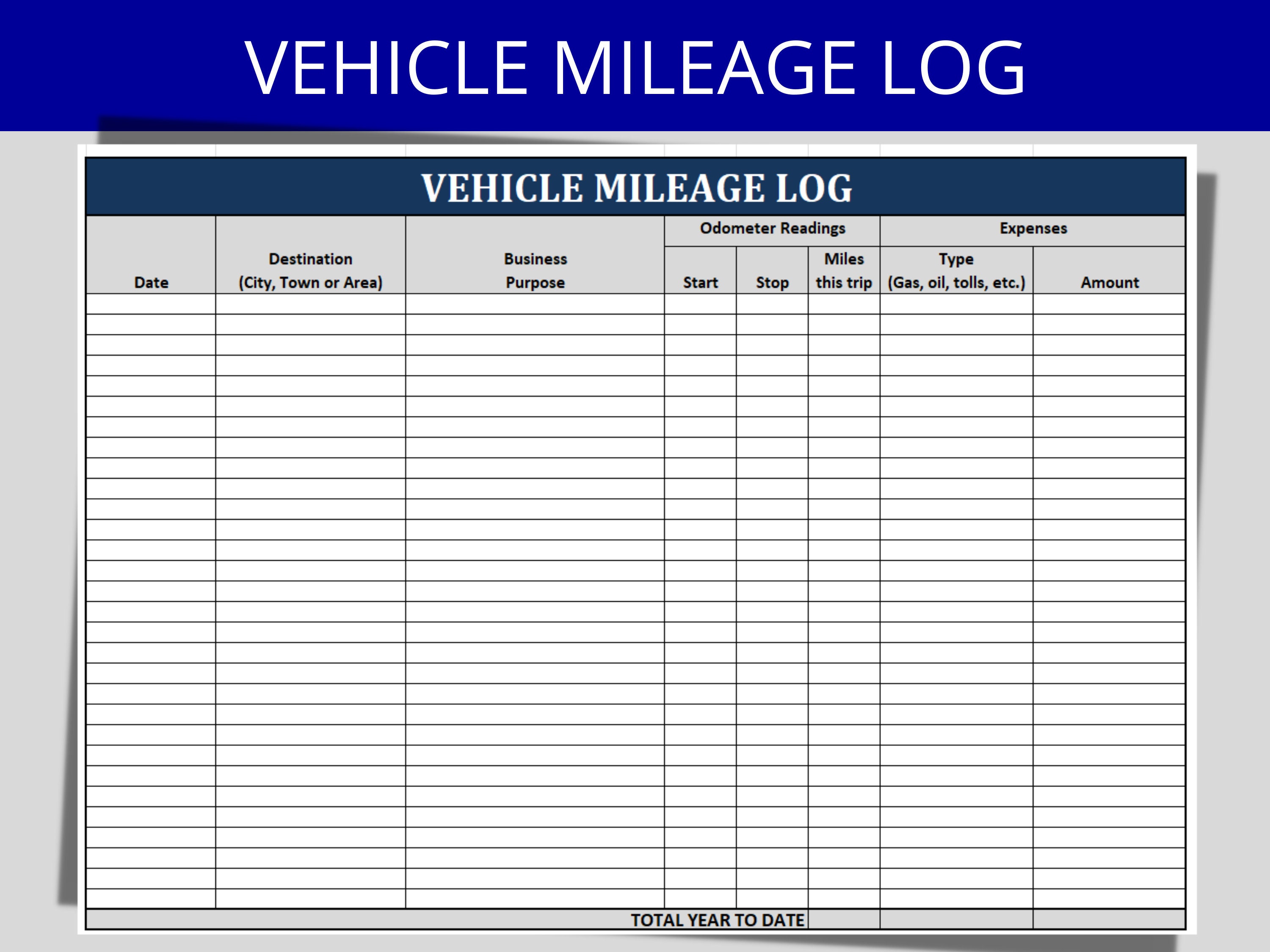

There's no refuting there are several benefits to tracking mileage for organization. There's additionally no sugar-coating that it can take up quite a little bit of time to do so manually. We obtain it as a local business owner, you already have an endless to-do list. Unless you're tracking mileage for settlement functions, exercising how to track gas mileage for job trips may not really feel like a critical job.

The 7-Second Trick For Mileagewise - Reconstructing Mileage Logs

The elegance of electronic tracking is that everything is recorded. In addition to optimizing your tax reductions by offering journey information and timestamps with pinpoint accuracy, you can eliminate detours and unauthorized individual journeys to boost worker accountability and efficiency. Looking for a thorough remedy to aid handle your company costs? We can aid! At Roll, we recognize that remaining on top of management tasks can be challenging.

Have you experienced the discomfort of looking at the organization trips thoroughly? The total miles you drove, the gas sets you back with n number of various other expenses., repeatedly. Generally, it takes practically 20 hours each year for a bachelor to log in their mile logs and other prices.

All about Mileagewise - Reconstructing Mileage Logs

Now comes the main photo, tax obligation reduction with gas mileage tracker is the broach the area. Claiming a tax obligation reduction for company has never been much easier than currently. All you need to do is pick between the techniques that pay you extra. In detail below, we have actually explained both ways by which you can claim tax obligation- reduction for business miles took a trip.

For your convenience, we have come up with the checklist of standards to be taken into check this site out consideration while selecting the best mileage monitoring application. Automation being a crucial consider any type of company, make sure to select one that has automated kinds which can determine costs quickly. Constantly try to find extra attributes offered, such as the quantity of time one has actually worked as in the most up to date applications.

What Does Mileagewise - Reconstructing Mileage Logs Mean?

They help you save time by determining your mileage and keeping a record of your information. Hence, Mileage tracker apps like Just Automobile help not just maintaining the mile logs yet also with the reimbursement of service miles.

Mileagewise - Reconstructing Mileage Logs for Beginners

government agency responsible for the collection of taxes and enforcement of tax obligation regulations. Established in 1862 by President Abraham Lincoln, the firm controls under the authority of the United States Division of the Treasury, with its main purpose comprising the collection of specific earnings taxes and work taxes.

Apple iOS: 4.8/ Google Play: 3.5 Stride is a totally free mileage and expense-tracking application that functions with Stride's various other solutions, like wellness insurance and tax-prep help. In addition to supplying websites to Stride's other items, it offers a gas mileage and expense-tracking function. I had the ability to download and install and mount the app conveniently and rapidly with both my apple iphone and a Galaxy Android tablet computer.

While the premium app supplies to link to your bank or charge account to streamline expensing, it will not link to your Uber/Lyft accounts. My (minimal) screening of Everlance showed extremely comparable gas mileages to Google Maps, so accuracy ought to get on the same level with the rest of the applications. mileage tracker. In general, I assumed Everlance was well-executed and simple to make use of, yet the functions of the free and also superior variations just didn't determine up to a few of the various other applications'